Welcome to my blog

JobKeeper declaration due 14 June

Businesses that have enrolled in the JobKeeper Scheme and identified their eligible employees are reminded that they will need to make a monthly declaration to the ATO to ensure they continue to receive JobKeeper payments.

The monthly declaration must be made by the 14th day of each month to claim JobKeeper payments for the previous month.

As part of the declaration, businesses will need to:

ensure they have paid their eligible employees at least $1,500 (before tax) in each JobKeeper fortnight they are claiming for;

re-confirm their eligible employees, including notifying if an eligible employee has changed or left employment; and

provide the current and projected GST turnover of the business – note, this is not a retest of the eligibility of the business.

For example, to claim JobKeeper payments for the May 2020 JobKeeper fortnights, businesses must report their GST turnover for the month of May 2020 as well as their projected GST turnover for the month of June 2020 by 14 June 2020.

The monthly declaration can be lodged through the ATO business portal. Alternatively, tax agents can assist clients by lodging the monthly declaration on behalf of registered clients.

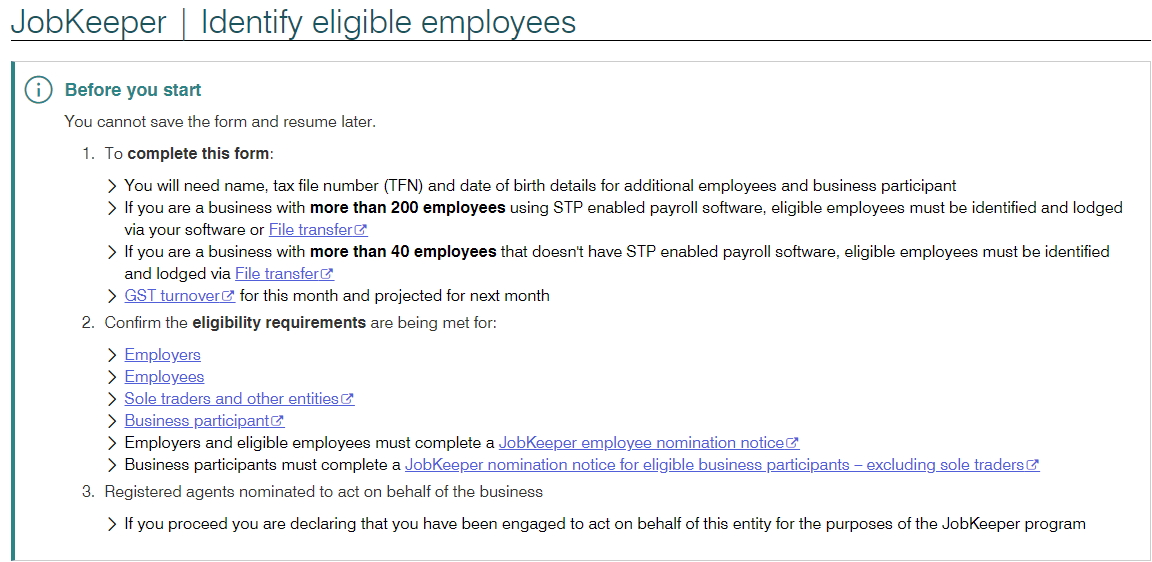

The following is the first screen we will see when starting an application for JobKeeper payments, referred to by the Taxation Office as "Identify eligible employees".

So, you will need to have the turnover for the current month (ie the month you are applying for eg April) and projected turnover for the next month (eg May). Generally, the Taxation Office allows you to cancel a form and come back to start again, if you don't have all the information you need when you look at it the first time.

The Taxation Office updated the employers JobKeeper guide ( https://www.ato.gov.au/General/JobKeeper-Payment/Employers/ ) today, to extend the date for April top up payments in conjunction with the extended date to enrol for JobKeeper:

There have been rapid developments with both the information provided by the Taxation Office and the actions that you can take (or your registered tax agent can take on your behalf).

The Taxation Office has posted the following Key Dates today:

From 20 April: enrol for JobKeeper payment.

By 8 May [Note: updated from 30 April, on 27 April]: pay your employees $1,500 for each fortnight to claim JobKeeper payments for April.

4 May onwards: identify your employees.

Each month: reconfirm eligibility.

If you need more time, you have until the end of May to enrol and identify your employees.

Importantly, you will have until the end of May if you run into any trouble enrolling for JobKeeper and need extra time.

The Taxation Office has also published JobKeeper guides for sole traders and employers last Friday, which have been updated today:

https://www.ato.gov.au/General/JobKeeper-Payment/JobKeeper-guides/

Make sure that you have an employee nomination notice for each eligible employee.

https://www.ato.gov.au/Forms/JobKeeper-payment---employee-nomination-notice/

From 4 May, after you have enrolled for JobKeeper, you (or your tax agent) will be able to claim the JobKeeper payment for April for your eligible employees.

You will need to identify each employee and the amount they have been paid during April. If you use Single Touch Payroll (STP), the information will be pre-filled, and just need confirmation. There is also a manual process, where you will identify your employees by entering their tax file number and date of birth. You can add potentially eligible employees manually, even if you have other employees that are pre-filled from STP.

Taxation Office updates 14 April 2020

JOBKEEPER – KEY POINTS FOR APRIL 2020